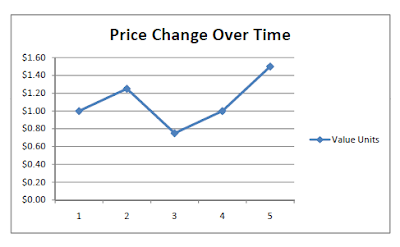

The projected return is supposed to be high. At first it seems to be getting higher but in the middle of the way, it went downwards for a while and is lower than the price at the time of purchase. Towards the end, the price recovers and is actually (as projected) higher than the price at the time of purchase. How do we manipulate this situation?

Option 1: Do a regular savings or auto-debit from your savings account. If you make sure that every scheduled investment is the same every time. You will get the above profit. If this happens in 3 years, average annual return would be 14.67%. But if this happens in a 5 year term, average annual return would be 8.8% a year.

Option 2: This option is almost the same as the above option, except that be purchase the units based on the price. The profit would be higher. If this happens in 3 years, the average annual return would be 19.67%, but if this happens in 5 years, the average annual return would be 11.80%.

Note: Sometimes this can actually happen within a year. Especially in a very aggressive fund.

No comments:

Post a Comment