Followers

Monday, 28 February 2011

Sunday, 27 February 2011

Firms turn in upbeat results, reward investors

The corporate reporting season for calender year 2010 was mostly upbeat as listed firms, especially the big boys, recorded solid earnings with shareholders duly rewarded, in some cases, with record dividends.

However, the outlook for the year ahead looks slightly uncertain for now, no thanks to the turmoil in West Asia where the fallout -- already evident in the escalating crude oil prices, now at US$113 per barrel -- is likely to dampen confidence and prospects for growth.

But still, there is something to shout about on the domestic front, taking into account that just two years ago, the global economy was bearing the brunt of the credit crisis and contracted by 1.7 per cent in 2009.

Malaysia’s corporate sector, which recovered strongly, undoubtedly reaped the benefits of the expanding economy where the gross domestic product (GDP) grew by a commendable 7.2 per cent in 2010 due mainly to the RM67 billion stimulus package and easing monetary stance which boosted business activities.

Read more: Firms turn in upbeat results, reward investors http://www.btimes.com.my/Current_News/BTIMES/articles/20110226142128/Article/index_html#ixzz1F7VqW7SS

However, the outlook for the year ahead looks slightly uncertain for now, no thanks to the turmoil in West Asia where the fallout -- already evident in the escalating crude oil prices, now at US$113 per barrel -- is likely to dampen confidence and prospects for growth.

But still, there is something to shout about on the domestic front, taking into account that just two years ago, the global economy was bearing the brunt of the credit crisis and contracted by 1.7 per cent in 2009.

Malaysia’s corporate sector, which recovered strongly, undoubtedly reaped the benefits of the expanding economy where the gross domestic product (GDP) grew by a commendable 7.2 per cent in 2010 due mainly to the RM67 billion stimulus package and easing monetary stance which boosted business activities.

Read more: Firms turn in upbeat results, reward investors http://www.btimes.com.my/Current_News/BTIMES/articles/20110226142128/Article/index_html#ixzz1F7VqW7SS

Saturday, 26 February 2011

CIMB rakes in record profit

CIMB Group Holdings Bhd (1023), the country's second largest lender, has posted a record net profit of RM3.52 billion in 2010 but is cautious over its prospects this year.

The RM3.52 billion was 25 per cent more than the RM2.81 billion net profit registered a year ago.

This was driven by the group's investment banking and CIMB Niaga, its Indonesian unit.

Group revenue rose 12.7 per cent to RM11.8 billion from RM10.5 billion in the previous year.

Group chief executive Datuk Seri Nazir Razak described 2010 as a good year but was cautious over its outlook in the current year.

Nazir anticipates different conditions in the region with slower economic growth, rising interest rates due to increasing inflation, and more volatile capital markets due to risks from Middle East crisis and potential hikes in oil price.

"Nevertheless, we are setting ourselves a higher returns on equity (RoE) target of 17 per cent for 2011.

"We will look to new areas for strong growth, such as regional transaction banking, CIMB Singapore and CIMB Thai," Nazir told a media conference in Kuala Lumpur yesterday.

"We will look to new areas for strong growth, such as regional transaction banking, CIMB Singapore and CIMB Thai," Nazir told a media conference in Kuala Lumpur yesterday.

CIMB will reward shareholders with a record dividend payout amounting to RM1.93 billion, or 26.08 sen per share.

During the year under review, the CIMB group's net earnings per share was 49 sen, while net RoE of 16.3 per cent exceeded its target of 16 per cent.

Read more: CIMB rakes in record profit http://www.btimes.com.my/articles/25CIMB/Article/#ixzz1F2YWdzpU

The RM3.52 billion was 25 per cent more than the RM2.81 billion net profit registered a year ago.

This was driven by the group's investment banking and CIMB Niaga, its Indonesian unit.

Group revenue rose 12.7 per cent to RM11.8 billion from RM10.5 billion in the previous year.

Group chief executive Datuk Seri Nazir Razak described 2010 as a good year but was cautious over its outlook in the current year.

Nazir anticipates different conditions in the region with slower economic growth, rising interest rates due to increasing inflation, and more volatile capital markets due to risks from Middle East crisis and potential hikes in oil price.

"Nevertheless, we are setting ourselves a higher returns on equity (RoE) target of 17 per cent for 2011.

CIMB will reward shareholders with a record dividend payout amounting to RM1.93 billion, or 26.08 sen per share.

During the year under review, the CIMB group's net earnings per share was 49 sen, while net RoE of 16.3 per cent exceeded its target of 16 per cent.

Read more: CIMB rakes in record profit http://www.btimes.com.my/articles/25CIMB/Article/#ixzz1F2YWdzpU

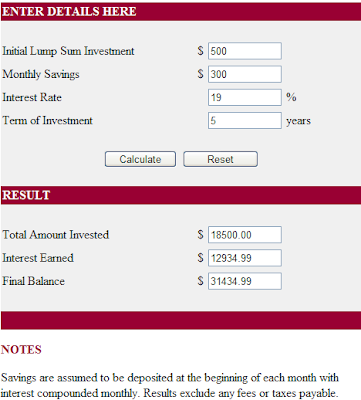

Financial Calculator Sample

RM500 for the 1st Investment is a must. It is the minimal investment required. Minimal top up is RM200 (minimum auto debit monthly is also 200). I use RM300 as a sample.

Beware of what you sign for ?

Without Prejudice

Folks,

the next time the postman or courier guy comes to deliver a registered letter, a certificate of posting letter

or parcel , do the following :

a) Check who is it from ?

b) If you do not know the source , reject it .

If you accept it without knowing the source , the following has happened and can happen to you too :

There have been cases where lawyers have done the following :

a) Mailed empty / sealed AR registered letters to people on behalf of their clients for some court case matter.

b) AR Registered mail , either, consisted of brochures promoting sale of new real estate or some car model

or just an empty A4 size paper inside .

In normal circumstances , when one receives an empty letter or junk mail, they will just tear and throw away , BUT BUT ,

here lies the danger :

a) You signed the AR registered card and it is returned to the law firm that that letter was delivered and the signed AR card

is proof of delivery and will be used against you in court.

b) Same applies to the so very convenient " CERTIFICATE OF POSTING " mail .

When the grace period for you to respond is over , they quietly go to court and show proof that an AR registered

letter was sent to you as a reminder and you did not bother to defend it and thus convince the court officials and get a

judgment against you.

Next another AR registered letter is sent to you asking for damages approved by the court , or just another empty envelope and you discard it once more and this time the

white collar crook will go to the court quietly and seek the assistance of the court to seal your property to recover the amount given by the court and soon the court bailiff

will be at your door step to execute the order .

What happens next ?

You frantically call your relatives in disbelief and seek legal advise . You are lost not knowing whats happening.

Anxiety , stress , palpitation , sleepless nights cannot be compensated as this is a reality check .

You engage a lawyer , spend a few thousand ringgit polishing their pockets for paper work and appeal to the High court

to set aside this matter .

What is your rights ?

a) You have every right to reject any mail / parcel that comes from unknown sources , be it a debt collection company,

law firm or some individual .

b) You have every right to ask the postman or the person delivering it to open the mail and let you see what is inside

and the contents of the letter.

c) REJECT it if you are not comfortable or ask them to deliver to a law firm that you know.

d) If you have inadvertently signed and collected the empty AR or empty ordinary registered mail,

lodge a police report and also report to the bar council as this will protect you if the matter goes

to court .

Eye opener isn't it , crime is beyond house break ins and snatch thefts , most of the time thieves get a few hundred ringgit

BUT here you spend thousands of ringgit , many hours spent traveling to court or to your lawyers office, not forgetting

the stress, anxiety , sleepless nights , etc.,

These days , the crooks come dress in suits , so beware and be smart.

Do inform your family members, mother in law, grand ma , maid, children , hubby ... NOT ..

DO NOT SIGN ON BEHALF OF ANYONE ... let them leave a card, go check at the post office , if not comfortable,

just reject it or ask the postman to open and show you what is inside.

Friday, 25 February 2011

CIMB Islamic Money Market Fund 25-2-2011

The Fund aims to provide investors with liquidity and regular income, whilst maintaining capital stability by investing primarily in money market instruments that conform with Shariah principles.

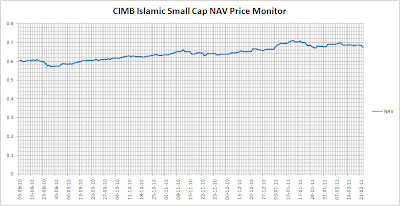

CIMB Islamic Small Cap Fund Monitor 25-2-2011

Decrease since latest highest price = -5.66%

Recomended Action = Switch to sukuk (Islamic bond) fund or invest more to take opportunity on cheap sale of this fund.

Thursday, 24 February 2011

EPF : Service Charges For Unit Trust Investment Capped At 3 Per Cent

Members of the Employees Provident Fund (EPF) will pay 50 per cent less in service charges for investment in unit trusts from January 1, 2008. The EPF announced that the service charges would be capped at three per cent, and fund management institutions cannot impose service charges beyond that.

This move as approved by the Minister of Finance will help members save on service charges. The service charges by local investment funds in Malaysia currently are relatively higher when compared with other countries like Singapore, United Kingdom, Japan and the United States.

“Members can enjoy better returns from their investment in unit trusts with the lower service charges,” said Datuk Azlan Zainol, Chief Executive Officer of the EPF.

Datuk Azlan also added, “We decided to cap the service charges at three per cent in the interest of our members and the fund managers”.

Currently members pay about five to six per cent in service charges.

“A study commissioned recently by EPF revealed that one of the major factors affecting the investment returns for our members is the high service charges imposed by the fund management institutions,” said Datuk Azlan.

About the Employees Provident Fund (EPF)

The Employees Provident Fund (EPF) is a national savings scheme, providing basic financial security for retirement. The Fund is committed to preserving and growing the savings of its members in accordance with best practices in investment and corporate governance. It will always be guided by prudence in its investment decisions.

As a customer-focused organization, the EPF delivers efficient and reliable services for the convenience of its members and registered employers.

The EPF continues to play a catalytic role in the nation’s socio-economic growth, consistent with its position as a leading savings institution in Malaysia.

Date: 12 December 2007

This move as approved by the Minister of Finance will help members save on service charges. The service charges by local investment funds in Malaysia currently are relatively higher when compared with other countries like Singapore, United Kingdom, Japan and the United States.

“Members can enjoy better returns from their investment in unit trusts with the lower service charges,” said Datuk Azlan Zainol, Chief Executive Officer of the EPF.

Datuk Azlan also added, “We decided to cap the service charges at three per cent in the interest of our members and the fund managers”.

Currently members pay about five to six per cent in service charges.

“A study commissioned recently by EPF revealed that one of the major factors affecting the investment returns for our members is the high service charges imposed by the fund management institutions,” said Datuk Azlan.

About the Employees Provident Fund (EPF)

The Employees Provident Fund (EPF) is a national savings scheme, providing basic financial security for retirement. The Fund is committed to preserving and growing the savings of its members in accordance with best practices in investment and corporate governance. It will always be guided by prudence in its investment decisions.

As a customer-focused organization, the EPF delivers efficient and reliable services for the convenience of its members and registered employers.

The EPF continues to play a catalytic role in the nation’s socio-economic growth, consistent with its position as a leading savings institution in Malaysia.

Date: 12 December 2007

Wednesday, 23 February 2011

Monday, 21 February 2011

Best time to invest!!

Market is rebounding! Now 1517, next stop is 1600. Strong trading volume expected this week after Chinese New Year + 7.2% 2010 GDP. INVEST MORE NOW!!!

Thursday, 17 February 2011

Can I switch between the Funds?

Can I switch between the Funds?

Switching will be conducted based on the value of your investment in a Fund. The minimum amount for a switch must be equivalent to the minimum withdrawal amount applicable to a Fund or such amounts as the Manager may from time to time decide. Please note that the minimum amount for a switch must also meet the minimum initial investment amount or the minimum additional investment amount (as the case may be) applicable to the fund to be switched into. Unit holders must at all times maintain at least the minimum balance required for a Fund to stay invested in that Fund. The Manager may, at its absolute discretion, allow switching into (or out of) a Fund, either generally (for all Unit holders) or specifically (for any particular Unit holder).

Since switching is treated as a withdrawal from one (1) fund and an investment into another fund, you will be charged a Switching Fee equal to the difference (if any) between the Application Fees of these two (2) funds.

For example, you had invested in a fund with an Application Fee of 2.0% on the NAV per unit and now wish to switch to another fund which has an Application Fee of 5.5% on the NAV per unit. Hence, you will be charged a Switching Fee of 3.5% on the NAV per unit on the amount switched.

In addition, the Manager imposes a RM100 administrative fee for every switch made out of a CIMB-Principal fund. However, this RM100 administrative fee is waived for the first four (4) switches out of a Fund in every calendar year and the Manager has the discretion to waive the Switching Fee and/or administrative fees.

Switching may also be subject to a withdrawal charge should the fund to be switched out from impose a Withdrawal Fee.

Switching into any CIMB-Principal fund is ultimately at the investor's personal choice and option. However, Muslim investors are ecnouraged to switch into any other CIMB-Principal Shariah fund rather than into any other CIMB-Principal conventional fund as it is not permitted from the Shariah perspective.

Switching into any CIMB-Principal fund is ultimately at the investor's personal choice and option. However, Muslim investors are ecnouraged to switch into any other CIMB-Principal Shariah fund rather than into any other CIMB-Principal conventional fund as it is not permitted from the Shariah perspective.

For CIMB-Principal Lifecycle Funds & CIMB Islamic Kausar Lifecycle Funds, switching is allowed:

- within the CIMB-Principal Lifecycle Funds / CIMB Islamic Kausar Lifecycle Funds; and

- from other CIMB-Principal funds into any of these Funds.

Subject always to the Manager’s absolute discretion, switching out from any of these CIMB-Principal Lifecycle Funds & CIMB Islamic Kausar Lifecycle Funds into other funds is not allowed.

No switching facility is available for CIMB-Principal Multi-Maturity Income Fund 1(formerly Multi-Maturity Income Fund 1), CIMB Islamic Commodities Structured Fund 1, CIMB Islamic Commodities Structured Fund 2, CIMB-Principal Opportunistic Bond Fund, CIMB-Principal China Recovery Structured Fund and CIMB-Principal Strategic Income Bond Fund as they are closed ended funds. Hence Switching Fee is not applicable.

Taken From : http://www.cimb-principal.com.my/Frequently_Asked_Questions.aspx#12

No switching facility is available for CIMB-Principal Multi-Maturity Income Fund 1(formerly Multi-Maturity Income Fund 1), CIMB Islamic Commodities Structured Fund 1, CIMB Islamic Commodities Structured Fund 2, CIMB-Principal Opportunistic Bond Fund, CIMB-Principal China Recovery Structured Fund and CIMB-Principal Strategic Income Bond Fund as they are closed ended funds. Hence Switching Fee is not applicable.

Taken From : http://www.cimb-principal.com.my/Frequently_Asked_Questions.aspx#12

Is there any exit fee when an investor withdraws his units?

Is there any exit fee when an investor withdraws his units?

No, there is no withdrawal fee charged except for the following funds:

- CIMB-Principal Lifecycle Funds

Up to 1.0% - A Withdrawal Fee of up to 1.0% of the NAV per unit is levied on a withdrawal made within two (2) years from the date the investment is accepted by the Manager. The Withdrawal Fee may differ between distribution channels. All Withdrawal Fees borne by Unit holders will be retained by the relevant Funds.

- CIMB Islamic Kausar Lifecycle Funds

Up to 1.0% - A Withdrawal Fee of up to 1.0% of the NAV per unit is levied on a withdrawal made within two (2) years from the date the investment is accepted by the Manager. The Withdrawal Fee may differ between distribution channels. All Withdrawal Fees borne by Unit holders will be retained by the relevant Funds.

- CIMB-Principal Multi-Maturity Income Fund 1 (formerly Multi-Maturity Income Fund 1)

Up to 2.0% - A withdrawal fee of up to 2.0% is chargeable on unscheduled redemptions. Unscheduled redemptions results from investors’ interest to withdraw their investments prior to the Fund’s predetermined scheduled withdrawals. Withdrawal fee will be 2.0% for the first year and will decline by 0.40% every year thereafter.

- CIMB-Principal Opportunistic Bond Fund

Up to 3.0% - A penalty of up to 3.0% of the NAV per unit is chargeable on any withdrawal made prior to the Maturity Date. All Penalty borne by Unit holders will be retained by the Fund.

- CIMB-Principal Strategic Income Bond Fund

A Withdrawal Penalty of up to 3.0% of the NAV per unit is chargeable on any

withdrawal made prior to the Maturity Date. All Penalties borne by Unit holders will

be retained by the Fund.

Payment will be paid in RM within ten (10) calendar days.

Wednesday, 16 February 2011

Tuesday, 15 February 2011

Friday, 11 February 2011

Having enough to spend after retirement

Put your eggs in many baskets. That’s the best way to ensure you will have enough to spend after retirement.

A MILLION ringgit just isn’t what it used to be. So if you’re thinking of retiring at 40 after making your first million, you might have to make new plans.

Simply having a chunk of money in the bank will not guarantee security, especially after you retire and face a completely different lifestyle with new financial needs. What you need is a sustainable retirement fund that will protect you from the uncertainties of the global financial situation and the increasing cost of living.

Personal financial coach and financial planner Carol Yip encourages people to plan their retirement savings wisely. She believes that people should have various reserves of funds, and regularly review their lifestyle to assess whether their nest egg will be sufficient.

Aside from daily living expenses and post-retirement luxuries, medical costs are our biggest concern during this period.

Click the link below to read more...

Having enough to spend after retirement

Thursday, 10 February 2011

Subscribe to:

Comments (Atom)